News & Updates

Now Viewing: Subcontractors vs. Employees

5 Reasons to Outsource Your Accounting & Bookkeeping

Published: April 30, 2024 • General Business Tips, Small Business Rescources, Subcontractors vs. Employees, Tips for Business OwnersI’m sure you’ve heard of the wildly popular sites such as Fiver and Upwork. On these sites, you can find just about any contract talent work that you need. People showcasing how they can help your small business on a project basis. Most of us also hire out web designers and a tax attorney or CPA to do our yearly tax returns. Grant it, some of us might have wicked skills in many areas but most small business owners aren’t good at everything. I’d like to argue just because you can doesn’t mean you should. You should be doing what […]

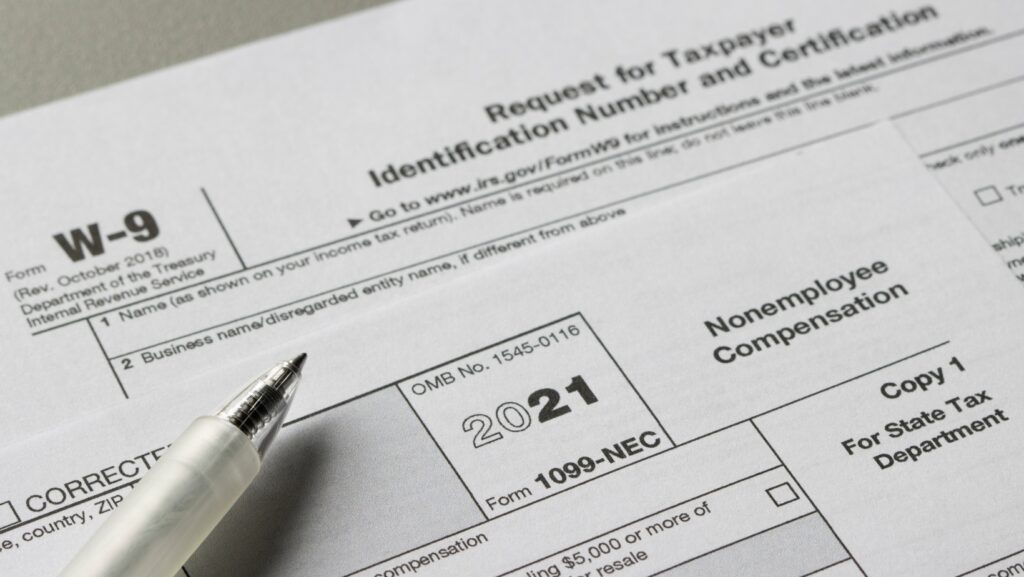

Track Subcontractors Using QuickBooks Online – A 5 Step Checklist

Published: January 26, 2024 • Financial Planning, Small Business Rescources, Subcontractors vs. EmployeesAs tax season approaches, businesses using subcontractors need to ensure they are tracking payments and preparing 1099 forms correctly. With QuickBooks Online, small business owners have a powerful tool to make this process easy. In this post, we’ll share expert tips on collecting W9 forms, recording expenses, separating reimbursements, and reviewing reports to make tax time straightforward. By following this advice, you can avoid headaches and feel confident submitting accurate 1099 info to the IRS and your subcontractors. A 5 Step Checklist 1. Collect a W9 Form Collect a W9 Form before paying your subcontractor for the […]